All Categories

Featured

Table of Contents

Bestow was established in 2016 and they are monetarily backed by the North American Firm for Life and Health And Wellness Insurance Coverage, an "A+" Superior rated insurance coverage company that has actually been running because 1886. Quick Online Term Life Insurance Policy - Offers $50,000 to $1,500,000 of insurance coverage for qualified applicants between the ages of 18 and 60.

In addition, they do not supply ensured renewability after your term has run out. Corebridge Financial, previously recognized as AIG, is a publicly-traded company (NYSE: CRBG) established in 2022.

Some Ideas on Best No-exam Life Insurance Companies You Need To Know

The business's rates are hard to beat, however making an application for coverage requires an agent's support. The Encova Mutual Life insurance policy Firm started as Motorist Mutual in 1928. Today the "A" Excellent rated insurance provider offers coverage to greater than 98,000 people and their products are offered by nearly 5,000 independent life insurance representatives.

Fidelity Life is an "A-" Excellent rated life insurance provider that was founded in 1896. The Integrity Life Insurance coverage company uses 4 different instantaneous concern or "RAPIDdecision" plans to applicants RAPIDecision Term - Uses up to $2,000,000 of degree term life insurance coverage for candidates matured 18 to 65.

These policies do not call for an exam for the first approval, yet unless you remain in ideal wellness, you will possibly require to finish an examination within 6 months of buying your coverage. This is a need that is one-of-a-kind to Integrity. RAPIDecision Senior Citizen Life Term - Supplies $10,000 to $150,000 of degree term life insurance policy to healthy candidates aged 50 to 75.

No Medical Exam Life Insurance Sproutt Vs Mintco Financial for Dummies

These plans provide to $25,000 of irreversible life insurance policy protection and they do not ask any type of medical concerns or call for an exam for approval. The trade-off with rated benefit life insurance is that it uses a reduced fatality advantage for the initial 3 years. Forester's Financial, likewise referred to as The Independent Order of Forester's, is a fraternal benefit society that was started in 1874.

PlanRight Whole Life Insurance - Like some of the other carriers on this listing, Forester's Financial uses 3 various whole life insurance policy items to those aged 50 to 85. Up to $35,000 of long-term life insurance policy is readily available and eligibility is based upon the applicant's general wellness and age. Dealt With Fatality Perks - Provides prompt protection for the complete face amount of the plan as soon as you make your very first payment.

Graded Death Conveniences - Gives an increasing percentage of the policy's face quantity for the very first 3 years of insurance coverage. This is usually the very best choice for those with serious health problems. Changed Fatality Conveniences - Provides restricted coverage for the first two years. Throughout this period if the insured dies, their beneficiary will certainly obtain a refund of the premiums paid into the plan plus rate of interest.

While no medical examination or questions are required for an authorization, the plan has a two-year waiting duration. If the insured dies during this time around, their recipient will receive a refund of the premiums paid into the plan plus 10% interest. Mutual of Omaha is an A+ rated life insurance carrier and Fortune 500 firm that has been operating because 1909.

- Mutual of Omaha offers up to $300,000 of instantaneous problem term life insurance coverage to applicants aged 18 to 70. In the table below, we have actually shown the optimum quantity of protection available for each age bracket.

Fascination About What Is An Instant Life Insurance Policy?

The business is "A" Superb ranked and their life insurance policy products are sold throughout the USA, Latin America, and the Carribean. Sagicor currently holds greater than $10 billion united state dollars in assets and produces $2.4 billion every year. - Long-term life insurance policy policies with survivor benefit ranging from $25,000 to $500,000.

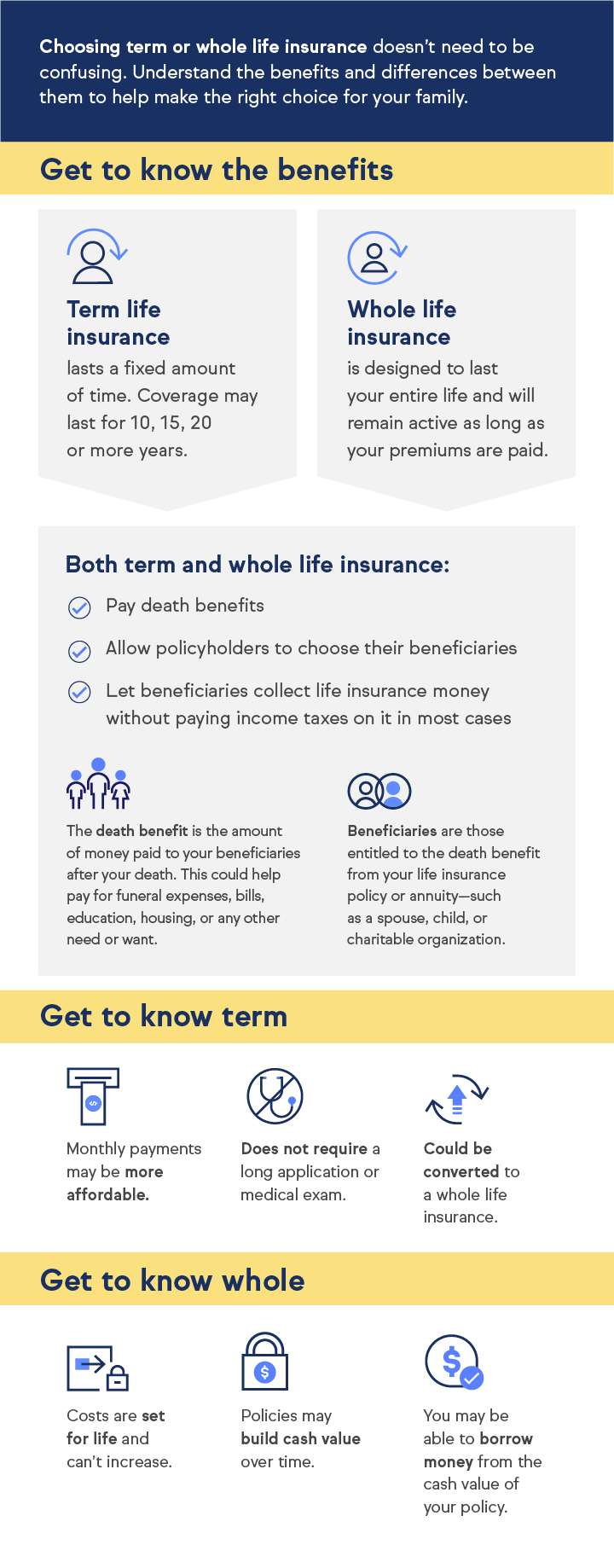

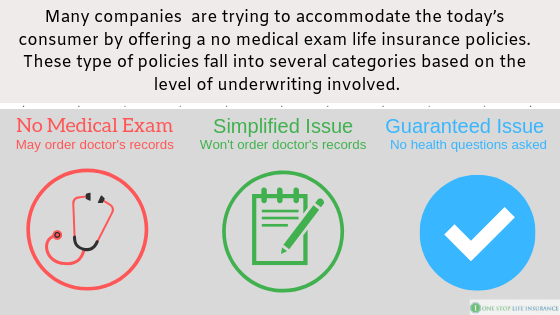

Life insurance policy without a medical examination is not a brand-new principle, yet it had not been often suggested till lately. New technology and algorithms have actually made it simpler for insurance provider to use no-exam insurance coverage at extra affordable rates. Below are some things you ought to know as you shop: When you choose no-exam insurance policy, there will certainly be a cap on the coverage quantity you can get.

The Single Strategy To Use For Best No Exam Life Insurance Companies Of 2025

When insurance providers provide no-exam life insurance policy, they handle added danger by not understanding how healthy you are. For that factor, most charge greater costs to balance that risk. No-exam policies have actually ended up being very affordable, yet you may also be paying greater than you would for a clinically underwritten policy.

Some have relatively couple of questions, while others can be really comprehensive. It is very important to be straightforward when responding to as it will guarantee the best deal for premium and shield your plan and its future advantages. If you are healthy, you may want to think about a plan with full clinical underwriting to obtain one of the most alternatives and ideal rates.

It's normally free and takes about 30 minutes. Depending upon your age and health, it can decrease your premiums substantially. Every insurance firm will have various items with various terminology and different options. When purchasing, it is necessary to understand the limits and advantages of each. Ask questions, and make certain you deal with a life insurance policy agent you can trust.

This is the most common no-exam life insurance policy, and it can can be found in a variety of forms. Most of the time, you finish a brief questionnaire concerning your health and get covered right away. Supplying restricted coverage amounts for a predicable premium, these policies may not be enough to protect your family members's needs, but they can assist cover last expenses.

It's an unfavorable fact that many individuals begin to think of life insurance policy just when they start having illness. By that time, it can be difficult to obtain the plan you desire at an expense you can afford. If you desire insurance coverage however have health and wellness problems that would likely invalidate you from receiving medically underwritten life insurance policy, no-exam life insurance policy may be your finest option.

Table of Contents

Latest Posts

Getting The What Is The Catch Behind No Medical Exam Life Insurance? If ... To Work

Getting The Fast Life Insurance: Best Companies For Quick, No-exam ... To Work

Not known Details About Term Life Insurance

More

Latest Posts

Getting The What Is The Catch Behind No Medical Exam Life Insurance? If ... To Work

Getting The Fast Life Insurance: Best Companies For Quick, No-exam ... To Work

Not known Details About Term Life Insurance